How I Structure My Finances

If we only take away one thing from this post it is to move away from banks that are charging you fees to hold your money.

The Barefoot Investor

I would like to start by acknowledging Scott Page, the author of The Barefoot Investor, for kick-starting my focus on my personal finance and defining the foundations for this post and the tool included.

The Bank and the Accounts

If we only take away one thing from this post it is to move away from banks that are charging you fees to hold your money. Finding a neobank (in my case ING) with no account or service fees should be a priority. Some other good options in Australia are Up and Me. If you want to stay with your current bank that is also ok, the process will be the same. Once you are ready we can start setting up the relevant bank accounts, these are split into 2 main categories:

- Type 1: Accounts with a physical bank card linked to them (typically the bank will only allow you to open 2 of these types of account)

- Type 2: Online savings accounts, no physical card (you should be able to open up to 10, but we will only need 2)

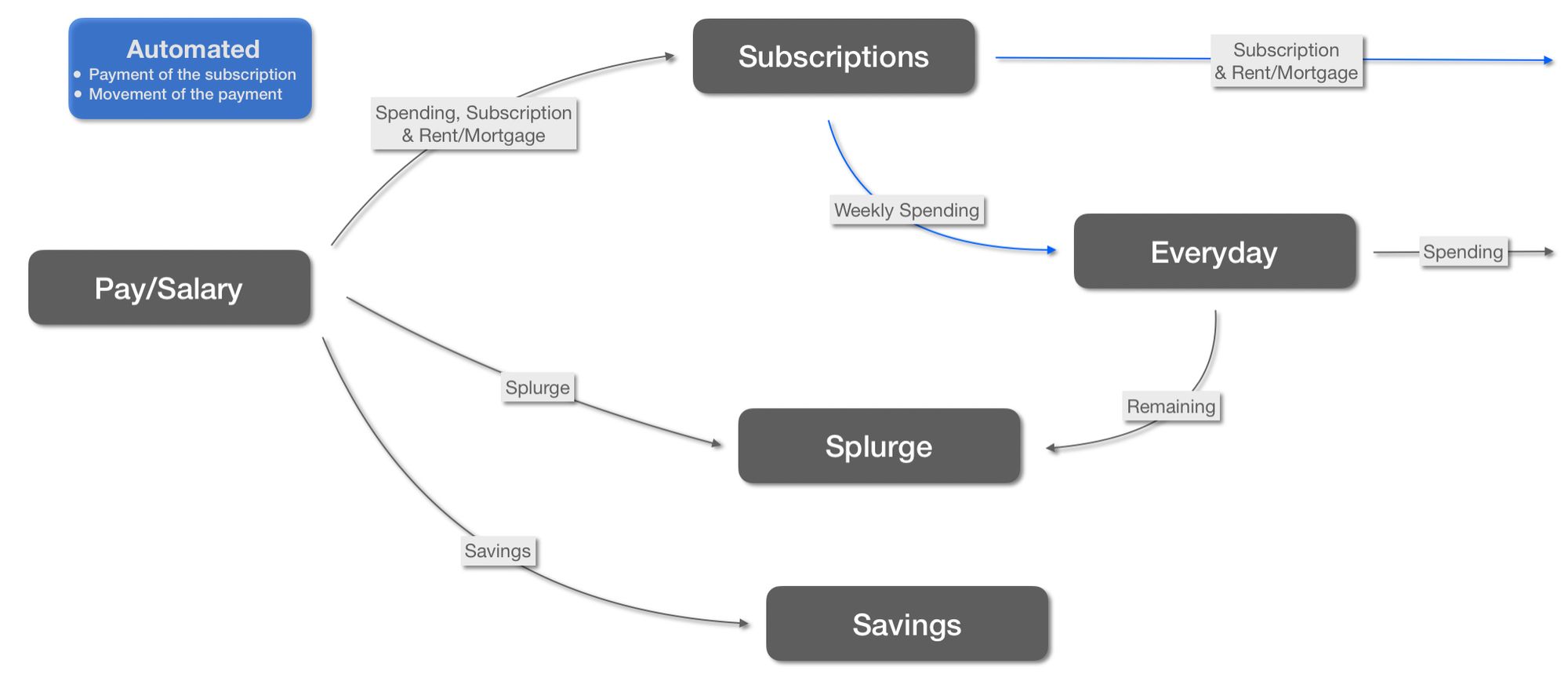

Next name the accounts according to the flow diagram below (the dark grey boxes), noting that Every day and Subscription should be the accounts with the physical cards. These accounts will be used for making payments outside your bank.

Everyday (Type 1)

Your everyday account should be used for everyday purchases. These can include buying lunch, and drinks after work, ordering Uber Eats for dinner, etc. This account will be topped up weekly from the Subscriptions account and you should choose an appropriate amount, in my case $200 per week. Looking through your past spending habits should give you a good ballpark figure to transfer here weekly.

Subscriptions (Type 1)

The most important thing to remember with the subscription account is to make sure you keep the card at home. This card should only be used for routine payments that have been captured in the subscriptions table. In other words, the money that flows through the subscription account should be automated and accounted for. Anything ad-hoc or once-off should be paid for with the Everyday account. In other words, if you can accurately predict the frequency and amount of a payment/purchase you should use this account to pay for it.

Splurge (Type 2)

This account has no rules. You top it up with the calculated amount from your pay or anything you have left over from the Everyday account at the end of the week. As the name suggests this account is for splurging, think fancy dinners, holidays, the new iPhone, etc.

Savings (Type 2)

The final account is for your personal savings. Balancing this account to be able to deposit as possible while also not drastically impacting your lifestyle should be the goal. What you should do with the money inside this account is outside the scope of this post, but, finding a high-interest savings account is a good place to start.

Pay Allocator Template

The remainder of this post covers the pay allocator tool and how to get started.

Firstly you should start by saving a copy of the sheet locally or duplicating it into your own google drive. It's also worth noting the cells which are coloured in white are formulas/lookup values which should not be edited. Starting at the top of the sheet, choose your pay cycle from the drop-down, this is how often you are paid by your employer. Next to that capture the value of your most recent pay (after tax), if this changes every payment you will want to use this tool every time you get paid.

The next step is to populate the subscriptions table. Start with replacing the amounts which have been prepopulated, Rent/Mortgage and Weekly Spending. Once you have entered the values, select from the drop-down the frequency of each payment and you should see a calculated value representing the subscription and salary frequency change in the Per Pay column.

Example - Weekly Spending

- Salary cycle is monthly

- Subscription cycle is weekly ($200)

- Therefore for every Salary payment you will need to set aside

$200 x 4.3 weeks = $865.80

Once you have populated all your subscriptions you should move on to the Salary Allocator table. Here you can add a buffer to the Subscription amount, in my case I add $50 a month. Lastly, you can adjust the split between your savings and splurge accounts depending on your individual situation, by default it is set to a 60/40 split.

The information in this blog is of a general nature. It does not take your specific needs or circumstances into consideration, so you should look at your own financial position, objectives and requirements and seek financial advice before making any financial decisions based on the information in this blog.